Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable. The generated Lorem Ipsum is therefore always free from repetition, injected humour, or non-characteristic words etc.

safe space for hero section ends here

optional use of the swoosh to finish the page

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

this column width (370) fits the mobile version

Headlines: size:

34 / lines: 44 (starting point)

Headline size that works well on mobile

use this font size as a starting point for good legability on desktop and tablet

There are two options for the top menu (see folders)

use spacer to seperate logos: 40px left and right of the line

top bar can have a background colour, a line or shadow at the bottom or sit free on transparent background

Watch here

How private banks are addressing digitalisation needs

from UK wealth CEOs

SPONSORED BY

Insights

How private banks are addressing digitalisation needs

Watch here

How private banks approach next gen clients

Watch here

Preparing for consumer duty

Watch here

Guiding clients through volatile markets

Watch here

Behind the race for private baking talent

Watch here

The biggest challenges private banks are facing

Watch here

Improving diversity and inclusion

Watch here

Mental wellbeing in focus

Watch here

Digitalisation

needs in focus

Watch here

The fight for next gen clients

Watch here

Preparing for consumer duty

Watch here

Guiding clients through volatile markets

Watch here

Behind the race

for talent

Watch here

The biggest challenges private banks are facing

Watch here

Improving diversity and inclusion

Watch here

Mental wellbeing in focus

Watch here

All bets are on: Are your portfolios ready?

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text. All the Lorem Ipsum generators on the Internet tend to repeat predefined chunks as necessary, making this the first true generator on the Internet. It uses a dictionary of over 200 Latin words, combined with a handful of model sentence structures, to generate Lorem Ipsum which looks reasonable. The generated Lorem Ipsum is therefore always free from repetition, injected humour, or non-characteristic words etc.

safe space for hero section ends here

optional use of the swoosh to finish the page

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

Body copy: size: 18 / lines: 30 (starting point)

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly believable. If you are going to use a passage of Lorem Ipsum, you need to be sure there isn't anything embarrassing hidden in the middle of text.

this column width (370) fits the mobile version

Headlines: size:

34 / lines: 44 (starting point)

Headline size that works well on mobile

use this font size as a starting point for good legability on desktop and tablet

There are two options for the top menu (see folders)

use spacer to seperate logos: 40px left and right of the line

top bar can have a background colour, a line or shadow at the bottom or sit free on transparent background

ADVERTISEMENT FEATURE

The market moves of the past 18 months have reminded investors that there is a difference between a long-term trend and an immutable truth and underscored the importance of genuine diversification in a world where market direction is much harder to determine.

2022 was a wakeup call for a lot of investors. Not only did bonds fall over 16%, one of the worst ever declines, but equities fell alongside them¹. This has rarely happened in the past 40 years, when disinflation and lower rates have dominated markets. In fact, most multi-asset portfolios are built on the assumption that bonds and equities will move in opposite directions.

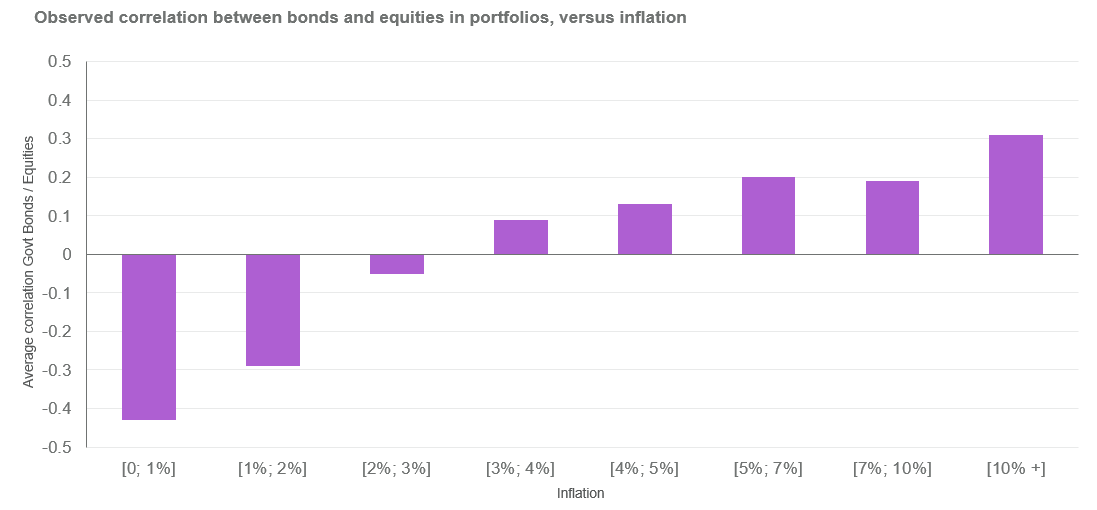

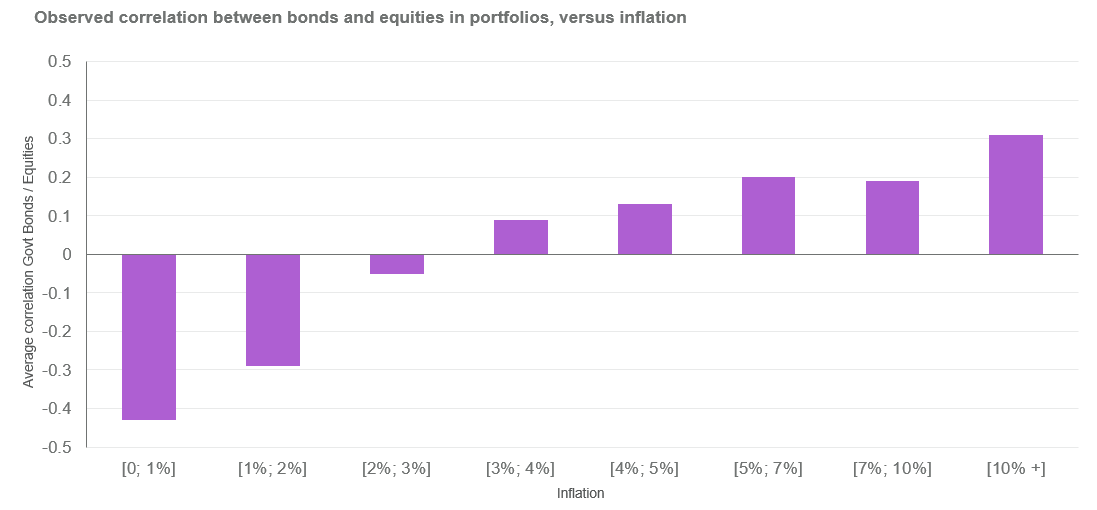

But, while it seldom happens, when it has a rise in inflation has been a contributing factor. As the chart below shows, there is a clear link between inflation and the correlation of stocks and bonds - and 2022 was no exception.

Source: Natixis IM, HIS Markit S&P Global – Mars. 2023

Not only did inflation rise to the top of investor worry lists last year, it also dominated the minds of central bankers who were forced into one of the fastest tightening cycles on record. The US Federal Reserve raised interest rates seven times, taking the fed funds rate from 0.25% in January of 2022 to 4.5% in December, the highest level since 2007.² Other central banks, with the exception of the Bank of Japan, followed suit. All in a bid to get inflation back under control.

Compounding the effects of this dual decline was the fact that portfolios have become steadily more concentrated over the past five years. Across the portfolios we examine, the typical number of strategies has reduced from 12, down to 8. As a result, the diversification benefit of investors’ portfolios, which is in essence the proportion of the risk that is diversified away has halved over just 4 years.

This was understandable given how one-sided markets had become leading into 2022. When interest rates are languishing near all-time lows, it is hard to argue with the idea that the next long term move in rates is going to be higher – or even much higher.

Similarly, when even a 100-year bond is offering a return of less than 1%, as the Austrian 100-year bond was in 2020³, it is difficult to make the case that bond yields have a lot farther to fall. And, when an idea like TINA - There Is No Alternative to equities – takes hold as a way to justify staggering valuations even for profitless companies, it becomes hard to dispute that markets had begun to feel a little frothy.

Interest rates are no longer at zero, there are no longer trillions of dollars of bonds languishing in negative territory and a lot of hot air has come out of markets. As a result, investors have become much less certain in their positioning – especially in the wake of the dual collapse of Silicon Valley Bank and Signature bank and UBS’s takeover of Credit Suisse.

While we may well be nearing the end of the current rate hiking cycle, predicting an extended downward move in yields would be a bold call - especially given how sticky inflation has remained. And, on the equity side, where a few years ago combining four technology stocks into an ETF would almost certainly have guaranteed outperformance, there is a growing recognition that fundamentals do actually matter and genuine stock picking expertise has an important role to play in the long-term outcomes of clients.

Which brings us back to diversification. The combination of increased concentration and re-correlation, that characterised markets in 2022, also resulted in a sharp increase in the volatility of risk-based model portfolios during the year. Equally unsurprising was investors’ reactions to that volatility.

The investor portfolio analysis we carried out earlier this the year showed an increased allocation to money markets and short-term bonds, as well as a renewed interest in non-directional strategies, partly because of the protection against inflation they purport to offer and partly for diversification reasons.

The overriding view expressed in the portfolios we look at at the start of the year was that the short end of the yield curve in the US, in Europe, and most developed markets was favourable because the hiking cycle still had a way to go. But, there was also an expectation for bond market volatility to recede as the year progressed and short-term rates to find their terminal level. This would see the yield curve steepen again and offer meaningful opportunities in the long end of the curve.

This may well still happen, but the picture has been complicated by the recent turbulence in the banking sector. Indeed, in early March investors were predicting that the interest rate range targeted by US Federal Reserve by the end of 2023 would rise as high as between 5.5% and 5.75% by the end of 2023. By the end of the month the predicted range had fallen to around 4%.⁴ But, the conviction in those views no longer seems quite as strong.

Looking ahead to the second half of the year what does seem clear is that with volatility still expected to be high, investors are once again valuing flexibility.

If 2022 demonstrated that the future doesn’t always look like the past and true diversification is more about the drivers of returns than simple asset classes, then the events of 2023 so far have underscored how much harder it is to build portfolios in a world where market direction is no longer easy to determine. When equities are no longer the only game in town, where there are great opportunities in different asset classes, and significant pockets of excess yet to unwind, the only real certainty is that true expertise has never been more important.

Natixis Investment Managers Solutions offers access to a diverse range of investment expertise with fully integrated services that put clients at the centre of every step of the investment journey. From design to delivery, we focus on one goal: building bespoke investment solutions to meet the specific needs of our clients.

Find out more from our collective experts

¹ Source

² Source

³ Source

⁴ Source

Julien Dauchez

Head of Portfolio Consulting & Advisory

Natixis Investment Managers Solutions

All bets are on: Are your portfolios ready?

CONTENT BY